Tally ERP 9 and Tally Price Course in Delhi. Job Oriented GST Course in Delhi

Jun 28th, 2025 at 10:58 Learning Delhi 1K views Reference: 28Location: Delhi

Price: Free Negotiable

Tally ERP 9 & Tally Price Course in Delhi

Tally ERP 9 is a leading accounting software widely used by businesses for financial accounting, inventory management, billing, payroll, and taxation, including GST compliance. In Delhi, several reputed institutes offer Tally ERP 9 and GST courses designed to meet industry requirements and enhance employability.

Tally ERP 9 and Tally Price Course in Delhi. Job Oriented GST Course in Delhi

Key Features of Tally ERP 9 Courses in Delhi

Comprehensive Curriculum: Courses cover basic to advanced Tally ERP 9 functionalities, GST setup and compliance, TDS, income tax, inventory management, billing, payroll, and financial reporting.

Job-Oriented Training: Institutes focus on practical, real-world accounting scenarios, ensuring students gain hands-on experience that prepares them for job roles in accounting, finance, and taxation.

Industry-Recognized Certification: Successful completion leads to certifications that are valued by employers in the accounting and finance sector.

Placement Assistance: Many institutes, such as SLA Consultants India and ATTITUDE Tally Academy, offer dedicated placement support, including interview preparation and job referrals.

Flexible Eligibility: Most courses are open to graduates from any stream (commerce preferred), and some accept students who have completed 10+2 or equivalent.

Course Duration and Structure

Short-Term and Diploma Options: Courses range from short-term (2-3 months) to diploma programs (up to 6 months), allowing flexibility for students and working professionals.

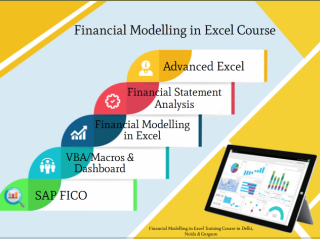

Modular Learning: Modules typically include Basic & Advanced Tally, GST Compliance, Advanced Goods & Services Tax Practitioner, and supplementary skills like Advanced Excel and SAP FICO for finance professionals.

Course Fees

Affordable Pricing: Basic Tally courses start from around 3,000 per month, with advanced and diploma programs ranging up to 12,000 for comprehensive packages.

Special Offers: Some institutes provide bundled offers, free study materials, or software access as part of the course fee.

Job-Oriented GST Course in Delhi

GST (Goods and Services Tax) training is a crucial part of modern accounting education, given the centrality of GST in Indian taxation. Delhi institutes integrate GST modules with Tally ERP 9 training for maximum job relevance.

Why Choose a Job-Oriented GST Course?

Industry Demand: GST compliance is mandatory for most businesses, making GST-trained professionals highly sought after in the job market.

Practical Exposure: Courses focus on real-time GST transactions, e-filing, tax payments, returns, and reconciliation using Tally ERP 9, ensuring students are job-ready upon completion.

Expert Faculty: Training is often delivered by experienced Chartered Accountants and industry professionals, providing insights into current practices and compliance requirements.

Career Opportunities: Graduates can pursue roles such as Accountant, Tax Consultant, GST Practitioner, Accounts Executive, and Finance Manager in diverse sectors.

Tally ERP 9 and Tally Price Course in Delhi. Job Oriented GST Course in Delhi

Conclusion

A Tally ERP 9 and GST course in Delhi is a strategic investment for anyone seeking a career in accounting, taxation, or finance. With practical, job-oriented training, recognized certifications, and strong placement support, these courses open doors to lucrative roles in the industry. Whether you are a fresher, working professional, or business owner, mastering Tally ERP 9 with GST compliance is a smart move for career advancement in today’s competitive job market.

https://slaconsultantsdelhi.in/training-institute-accounting-course/

https://slaconsultantsdelhi.in/gst-course-training-institute/

Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax)

Module 2 - Part A – Advanced Income Tax Practitioner Certification

Module 2 - Part B - Advanced TDS Practical Course

Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 - Part B - Banking & Finance

Module 4 - Customs / Import & Export Procedures - By Chartered Accountant

Module 5 - Part A - Advanced Tally Prime & ERP 9

Contact Us:

SLA Consultants Delhi

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://slaconsultantsdelhi.in/